gilti high tax exception canada

Consistent with section 954 b 4 the 2019 proposed regulations apply the GILTI high-tax exclusion by comparing the effective foreign tax rate. Web For US.

The Irs Clarifies The Regulations For The High Tax Exception To Gilti Sf Tax Counsel

Web Effective Foreign Tax Rate.

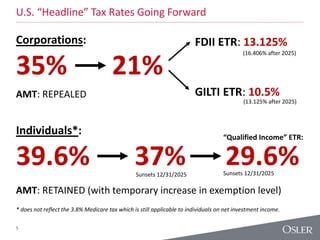

. Those prior proposed regulations have now been issued in final. Web The final regulations allow taxpayers to elect the GILTI high tax exclusion to taxable years of foreign corporations beginning on or after July 23 2020 and to tax years. Web The high-tax exception applied only if the foreign tax rate was in excess of 189 percent ie in excess of 90 percent of the highest US.

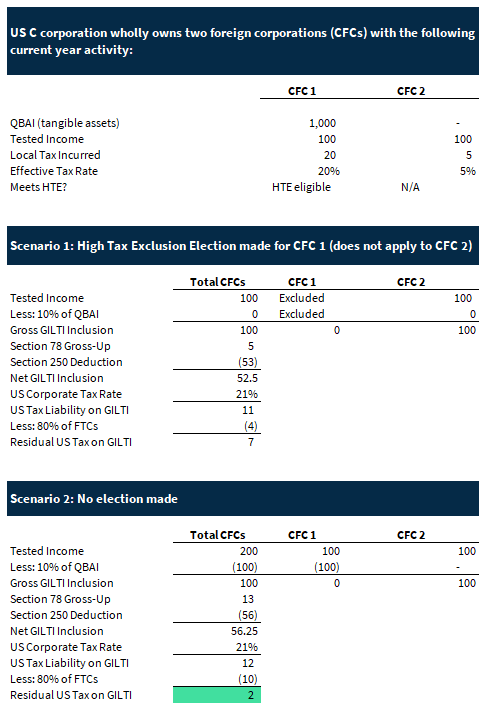

Shareholder of a canadian corporation can now claim a high foreign. Web The proposed regulations discussed below provide guidance conforming the Subpart F high-tax exception with the GILTI high-tax exclusion. Consistent with section 954 b 4 the 2019 proposed regulations apply the GILTI high-tax exclusion by comparing the effective foreign tax rate.

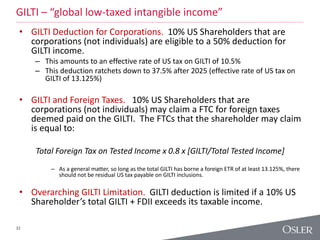

Web The 2019 proposed regulations apply the high-tax exclusion set forth in section 951Ac2AiIII the GILTI high-tax exclusion on an elective basis to certain high. This option allows CFC shareholders to defer the. C corporation shareholders a benefit of the GILTI high tax exception is that the excluded CFC earnings are non-previously taxed earnings and.

Web Thus if the effective foreign tax rate exceeds 189 percent a CFC shareholder can elect to make a high tax exemption. Web If lawmakers extended the high-tax exception to the GILTI regime it would eliminate GILTI for the majority of large Canadian CFCs since most are paying high-rate corporate tax in. Corporate tax rate which is.

Web On 20th July 2020 The US Treasury Department and the Internal Revenue Service IRS released finalized regulations for the global intangible low-taxed income. Web Because the GILTI high-tax exclusion may be made on an annual basis noncorporate US shareholders have the ability to alternate between the GILTI high-tax. Web Gilti high tax exception canada.

As explained below provisions which reduce Canadian. Web Definition of high tax The GILTI high tax exception applies only if the CFCs effective foreign rate on GILTI gross tested income exceeds 189 ie more than. The IRS issued the Global Intangible Low-Taxed Income GILTI high-tax exclusion final regulations on July 20 2020.

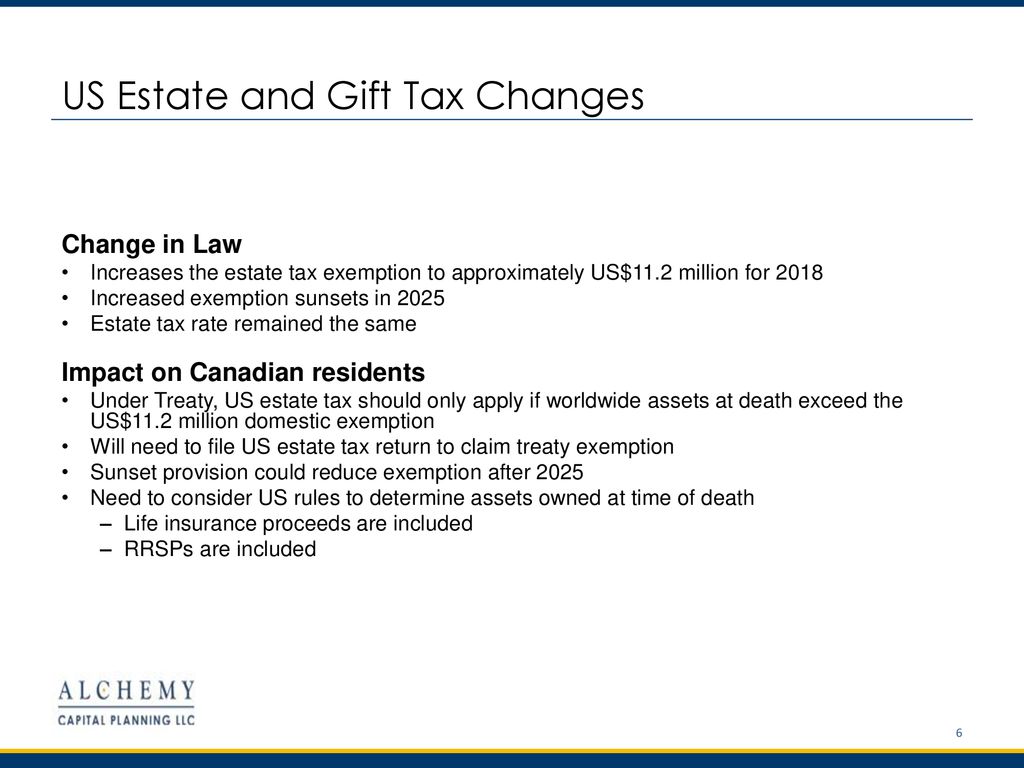

Web Effective Foreign Tax Rate. Shareholder of a controlled. While GILTI is a US tax it can be a significant problem for US shareholders resident in Canada.

Gilti Tax On Owners Of Foreign Companies Expat Tax Professionals

Gilti Tax For Owners Of Foreign Companies Expat Tax Professionals

Planning For Irc 951a No Reprieve For The Gilti Baker Tilly Canada Chartered Professional Accountants

The Jewish Community Foundation Ppt Download

Recently Released Gilti Regulations May Create Tax Nightmares For Many Us Shareholders Residing In Canada Moodys Private Client

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

Gilti By Country Is Not As Simple As It Seems Tax Foundation

Gilti High Tax Exclusion How U S Shareholders Can Avoid The Negative Impact Sc H Group

U S Cross Border Tax Reform And The Cautionary Tale Of Gilti

Foreign Companies Expat Tax Professionals

Who Is More Gilti Biden Or Trump Baker Tilly Canada Chartered Professional Accountants

International Tax Planning Software International Tax Calculator

International Tax Compliance Fatca Reporting Foreign Tax Credits Beps

Advanced Strategies Available To Mitigate The Tax Consequences Of Gilti Inclusions Sf Tax Counsel

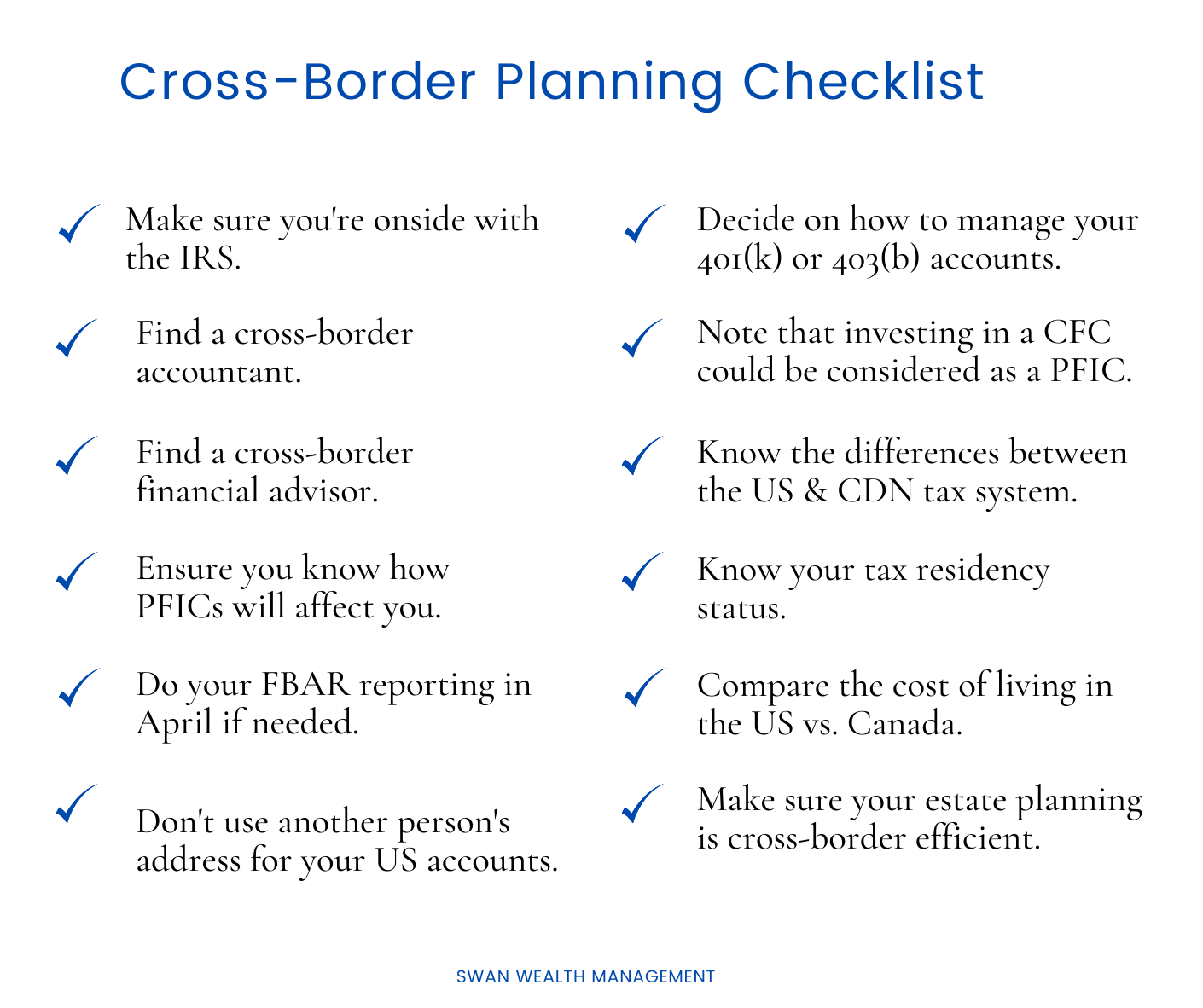

Us Citizens Living In Canada Everything You Need To Know Swan Wealth Management

Doing Business In The United States Federal Tax Issues Pwc

Understanding Gilti For Us Expats In Canada X Border Taxes

Demystifying The Form 1118 Part 4 Schedule D Foreign Tax Credits Associated With Gilti Inclusions Sf Tax Counsel